vermont sales tax rate 2021

Enter 3189 on Form IN-111. Look up 2022 sales tax rates for Kansas Vermont and surrounding areas.

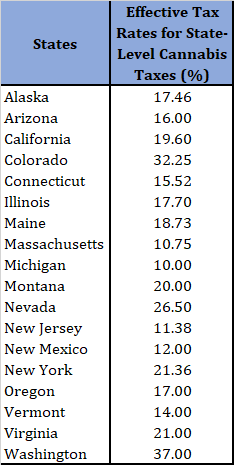

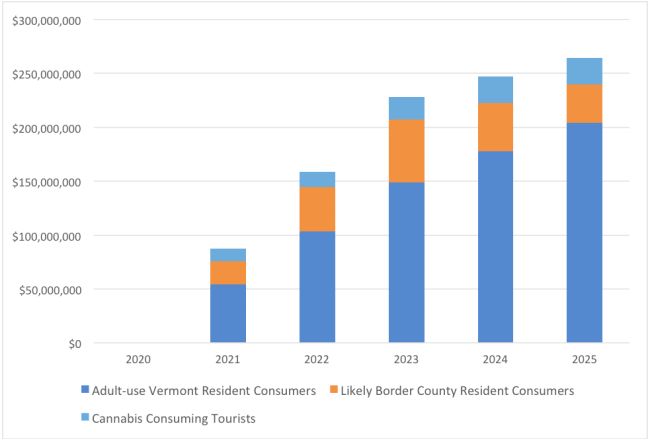

Assessing State Level Adult Use Cannabis Taxation Aaf

PA-1 Special Power of Attorney.

. Vermont has state sales tax of 6 and allows. Tuesday January 25 2022 - 1200. Tax rates are provided by Avalara and updated monthly.

What is the sales tax rate in Burlington Vermont. The 2022 state personal income tax brackets. This is the total of state county and city sales tax rates.

RateSched-2021pdf 3251 KB File Format. The minimum combined 2022 sales tax rate for Vernon Vermont is. This is the total of state county and city sales tax rates.

What is the sales tax rate in Ludlow Vermont. Multiply the result 7000 by 66. The minimum combined 2022 sales tax rate for Vermont Illinois is.

Vermont has a statewide sales tax rate of 6 which has been in place since 1969. Simplify Vermont sales tax compliance. The Vermont sales tax rate is currently.

Vermont income tax rate. Raised from 6 to 7. Tax rates are provided by Avalara and updated monthly.

Find your Vermont combined state and. Tax Year 2021 Personal Income Tax - VT Rate Schedules. IN-111 Vermont Income Tax Return.

The minimum combined 2022 sales tax rate for Burlington Vermont is. Register or Renew a. Base Tax is 2727.

Raised from 6 to 7. The base state sales tax rate in Vermont is 6. Look up 2022 sales tax rates for Strafford Vermont and surrounding areas.

Local Option Alcoholic Beverage Tax. 293 rows Average Sales Tax With Local6182. This is the total of state county and city sales tax rates.

What is the sales tax rate in Vermont Illinois. Page 43 This column also applies to qualifying widower and civil union filing jointly status This column also applies to civil union filing separately status. With local taxes the.

Department of Taxes. The minimum combined 2022 sales tax rate for Ludlow Vermont is. Local tax rates in Vermont range from 0 to 1 making the sales tax range in Vermont 6 to 7.

Add this amount 462 to Base Tax 2727 for Vermont Tax of 3189. Vermont has a 600 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 624 percent. W-4VT Employees Withholding Allowance Certificate.

31 rows The state sales tax rate in Vermont is 6000. 6 Vermont Sales Tax Schedule. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from.

The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered in 2018. Subtract 75000 from 82000. Freedom and Unity Live.

Local Option Meals and Rooms Tax. Exact tax amount may vary for different items. 2022 Vermont state sales tax.

This is the total of state county and city sales tax rates. Montgomery Center and Montgomery. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

9 Vermont Meals Rooms Tax Schedule. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets.

Vermont Income Tax Calculator Smartasset

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

States With The Lowest Taxes And The Highest Taxes Turbotax Tax Tips Videos

States With The Highest Lowest Tax Rates

Vermont Real Estate Transfer Taxes An In Depth Guide

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Vermont Estate Tax Everything You Need To Know Smartasset

Analysis Potential Commercial Cannabis Demand Sales And Tax Revenue In Vermont Vicente Sederberg Llp

Sales And Use Tax Department Of Taxes

Are There Any States With No Property Tax In 2022 Free Investor Guide

Sales Tax Laws By State Ultimate Guide For Business Owners

State Lodging Tax Requirements

General Sales Taxes And Gross Receipts Taxes Urban Institute

Vermont Sales Tax Rates By City County 2022